Green finance is rising up the agenda and will pretty soon affect not only every financial institution in the world but everyone borrowing money from those institutions, including borrowers in Cyprus.

I was able to catch up on where the world is at with green finance during the second Green and Sustainable Finance Conference, on 18 January in Nicosia. It was organized by ideopsis Ltd and Grant Thornton (Cyprus) Ltd and was supported and co-funded by the British High Commission in Cyprus.

My role was to stand between the attendees and lunch at the end of the conference and pull out the key findings. I am sharing these findings below, as well as some additional context where appropriate.

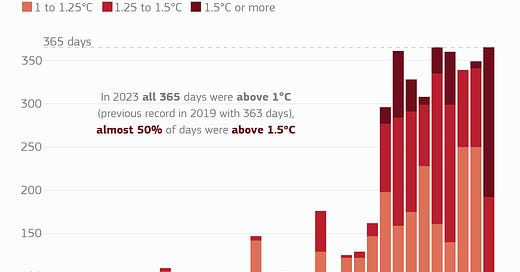

We are already touching 1.5 degrees

One of the scariest pieces of information from the conference was that in 2023 the planet had already come close to the 1.5 degrees Celsius (1.5°C) threshold agreed at the Paris Climate summit in 2015. The reason 1.5°C was picked was because it is the limit beyond which life conditions are expected to deteriorate very rapidly. (Beyond 3°C and we would be on that SpaceX shuttle to Mars.)

The Copernicus Climate Change Service reported that in 2023 global air surface temperatures were 1.48°C warmer than the 1850-1900 pre-industrial level. The threshold technically has to be hit much for longer than a year to be officially in breach. Nevertheless, the past two years have not been encouraging. This is no doubt why the British High Commissioner, Irfan Siddiq, said that despite the many geopolitical distractions, the climate crisis is our “greatest long-term threat”.

Regulation is accelerating

What became clear from the conference is that regulation is already accelerating, as demonstrated by the accumulation of EU abbreviations on it. We already have the EU Taxonomy (2020) and the Corporate Sustainability Reporting Directive (CSRD) (2021). The next steps are the European Sustainability Reporting Standards (ESRS) and the Corporate Sustainability Due Diligence Directive (CSDDD). We also have new terms like “double materiality”. A good explainer on these terms by Raiffeisen Bank International can be found here. It says “companies will need to implement human rights and environmental due diligence to all the entities in their organization”.

During the conference it was also suggested that ultimately the rules could affect bank capital requirements as well as personal liability for directors. In other words, running a non-green businesses is going to get very costly.

Measurement is still a work in progress

The other highlight that came out of the ideopsis conference was that consensus on environmental, social, and corporate governance (ESG) measurement is still a work in progress. First, there is the problem of “green-washing”. The Financial Times reported in June 2023 that “EU regulators have found evidence of widespread greenwashing across the financial system, as concerns grow that banks, asset managers and insurers are overstating their climate credentials”.

It does not help that in many cases the statistics to make the assessments currently do not exist. In the absence of actual data, banks have to resort to proxy measures for things like greenhouse gas (GHG) emissions. They are getting support in measurement from organizations such as the Partnership for Carbon Accounting Financials (PCAP), which is developing a Global GHG Accounting & Reporting Standard. Bank of Cyprus is already one of its growing number of members.

The global market is already responding

The good news is that the local and global market is already responding. Cyprus issued its first “sustainable bond” for €1bn in April 2023, which was oversubscribed multiple times (i.e. it was extremely popular) and was hailed by Global Capital as the “bond of the year” in the category of Sovereign, Supranational and Agency (SSA) ESG bonds.

ESG funds in Luxembourg—the world leader for investment funds—have already reached €2.8 trillion. Moreover, ESG undertakings for collective investment in transferable securities (UCITS) (the most popular type of fund) already account for 67.3% of all assets under management (AUM) in Luxembourg according to Funds Europe. Given Luxembourg’s importance for global funds, companies in jurisdictions that are less friendly to ESG policies are finding that they cannot avoid them.

The global rise in green bonds is being supported by organizations like the Climate Bonds Initiative, which is developing, inter alia, the Climate Bonds Standard and Certification Scheme. In its report for the second half of 2023, the Climate Bonds Initiative found that “Green bonds achieved higher book cover and spread compression than vanilla equivalents, on average”. In layperson’s terms, it means that it is generally easier to obtain finance for green bonds than it is for the traditional ones.

But there is still a long way to go

While things are definitely moving, and banks in Cyprus are responding, there is clearly still a long way to go. On 23 January the European Central Bank (ECB) found that 90% of significant institutions were “misaligned” and 70% were “also subject to elevated reputational and litigation risk”. (A more digestible version of the findings can be found here.)

This means that banks will be demanding a wide range of indicators from borrowers (starting with larger companies) to be able to assess their ESG credentials, and from that to price loans to business.

Cypriot business can therefore expect a whole raft of uncomfortable questions when they go to banks for loans. What is the source of your heating/cooling? (And let me see your electricity bill to prove it.) How do your staff travel to work? Can you prove that? What have you demonstrably done to reduce your carbon footprint this year? And so on and so on. Producing the answers will be costly. But the alternative is higher interest rates on your loan, or no loans at all.

Really appreciate the comprehensive takeaways and implications